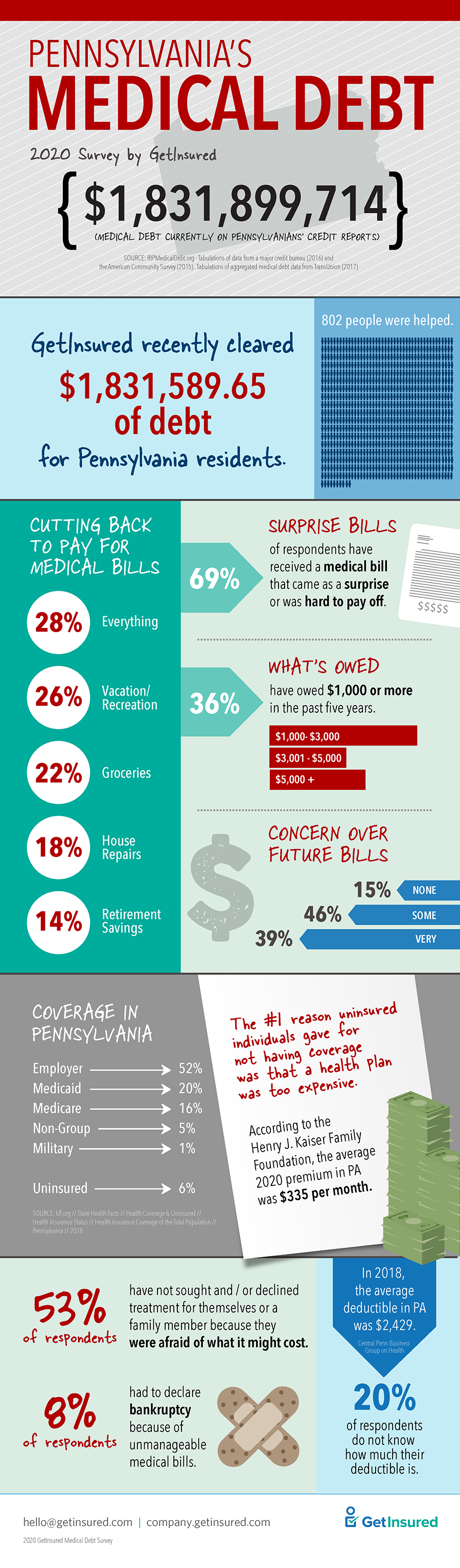

Just in time for Valentine’s Day, GetInsured retired more than $1.8 million of medical debt in the Commonwealth of Pennsylvania. This comes after the company relieved debt in three other states. A survey done by GetInsured revealed high levels of financial anxiety when it comes to healthcare costs, similar to findings in other states.

According to the survey, although more than 90 percent of survey respondents have health insurance, more than half (53 percent) admit to declining treatment for themselves or a family member out of fear of what it might cost. “Emergency care” was the leading cause of health services that have led to medical debt or financial difficulty. Nearly 70 percent report receiving a medical bill for a high dollar amount that came as a surprise or was difficult to pay, while 40 percent are “very concerned” about this happening in the future.

GetInsured worked with RIP Medical Debt, a nonprofit organization, to locate and purchase the medical debt. RIP Medical Debt buys medical debt on the secondary debt market in bulk. They cannot relieve medical debt by individual request. Recipients of GetInsured’s charitable gift have spent more than five percent of their gross income on medical bills and reside across the Commonwealth.

The Pennsylvania Resident Medical Debt Survey was conducted online in December 2019 among more than 400 adults ages 18+ who reside in Pennsylvania. For more information about this survey and GetInsured’s commitment to alleviate medical debt nationwide, visit https://company.getinsured.com/medical-debt-forgiveness/.