Since the launch of the Affordable Care Act, we’ve seen federal administrations come and go, yet throughout the changes and enhancements to the law over time and across party lines, one thing has not changed — state-based exchanges (SBEs) have and will continue to provide states the autonomy and flexibility in addressing the unique needs of health insurance markets and consumers around the country in a way that healthcare.gov cannot.

Randy Pate, who most recently served as Director of the Center for Consumer Information and Insurance Oversight (CCIIO) in the federal Centers for Medicare & Medicaid Services (CMS), says, “I can tell you firsthand of the importance of states in regulating their own health insurance markets. States, rather than the federal government, are in the best position to address issues unique to their markets and to their citizens. States are more responsive to the specific needs of their communities and are better able to protect the interests of consumers. And states are at the forefront of creativity and innovation in addressing the crisis facing America’s healthcare system.”

Due to variances in state populations, income, education, and health status, the mix and geographic location of doctors, hospitals, and clinics, and the level of insurer competition, agent/broker penetration in the market, and regulatory environment, there truly is no one-size-fits-all federal solution when it comes to operating a health insurance exchange. The flexibility and cost savings (i.e., millions of dollars that are redirected from the federal government back to the state) that state-based exchanges provide empowers states to drive real and lasting change in their markets. New Jersey and Pennsylvania, the two most recent states to move off the FFM, saw a decrease in premiums, an increase in enrollments, and a large reduction in operating costs just during their first open enrollment period as SBEs.

Benefits of a state-based exchange, as outlined by Pate, include:

- More control over the direction of their health insurance market. Under federal law, states operating their own SBEs are given significant latitude to design and implement exchanges within federal standards. For example, SBE states are given full control over Qualified Health Plan (QHP) certification and in conducting outreach and marketing efforts. QHP certification encompasses all aspects of reviewing and approving rates, benefits, forms, marketing materials, and other materials under traditional state regulatory oversight, but also extends to final decisions on whether to certify or decertify QHPs. In addition, SBEs have the authority to set and collect user fees as well as determine rules around special and annual enrollment periods.

While minimum federal regulatory standards apply to each of these areas, states are generally given flexibility to design and implement SBEs as they see fit within those standards. For example, states could choose to build SBEs in a way that facilitates private sector pathways to coverage such as brokers and insurance carriers, enabling these partners to offer more tailored, customized consumer shopping experiences that are often preferred by newer, younger consumers needed to stabilize the risk pool, as we are seeing in the State of Georgia.

- Better technology and lower costs make it easier than ever for states to establish and operate their own SBEs, saving taxpayers and enrollees money. Back in 2013, a number of states spent hundreds of millions of federal taxpayer dollars to build their own health insurance exchanges. Much of this spending was wasteful and led to poor results for consumers. However, like with most other technologies, the cost of building an exchange has gone down significantly while technology and performance has drastically improved. Recently states including Nevada, Pennsylvania, and New Jersey have successfully migrated away from the federal platform to create their own exchanges at a fraction of the cost of the earlier exchanges. They are also able to run their exchanges at a lower user fee than other states and the federal government.It is important to note that today, enrollees on the federal platform pay user fees to the federal government in the form of higher health insurance premiums. The burden of paying the user fee falls primarily on taxpayers and unsubsidized enrollees who don’t directly benefit from using the exchange. By establishing its own exchange, states would have the opportunity to reduce this burden on its enrollees by charging a lower user fee or seeking an alternative means to fund exchange operations.

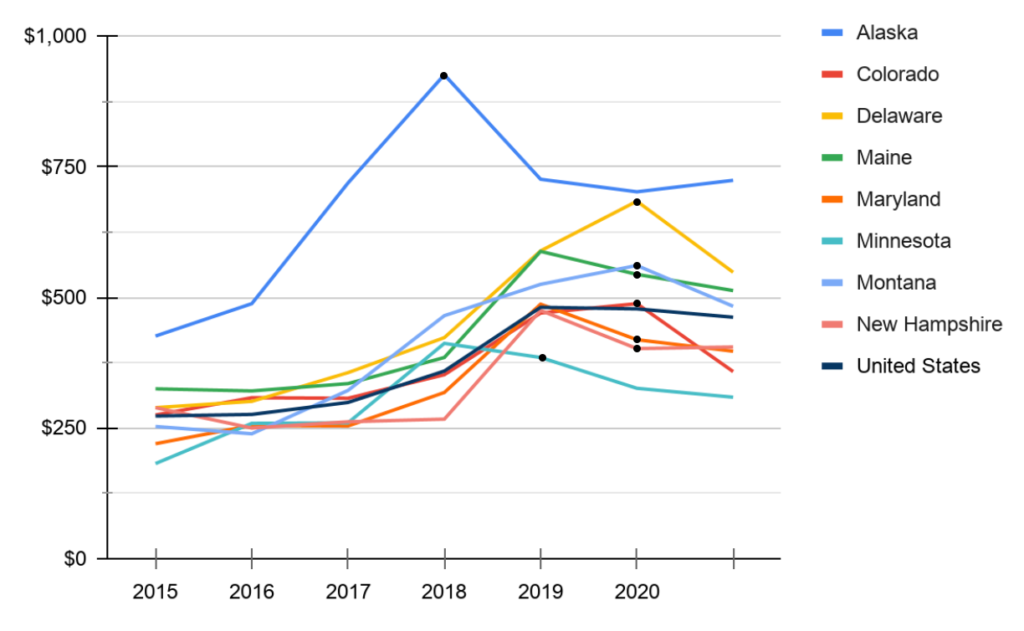

In addition to setting up exchanges, reinsurance pools in several states have proven an effective way to lower premiums, saving both the consumer and the state money. The below graph illustrates the decline in premium costs after initiating a reinsurance pool (marked by the black dot on the line graph).

- A well-designed SBE can serve as the foundation for future, market-based reforms. Because of the additional regulatory and design flexibility afforded them, SBEs can also be effective platforms for implementing market-oriented health reforms. In November 2019, CMS issued four waiver concepts designed to take full advantage of the ACA’s Section 1332 State Innovation Waivers. These concepts include reforms that make coverage more affordable, available, and consumer-centric, including:

-

- State-Specific Premium Subsidies: Redefine the amount of financial assistance provided as a state subsidy, such as a state tax credit, or redefine the populations eligible for financial assistance. To-date, California and New Jersey have implemented state-specific premiums.

- Adjusted Plan Options: Provide state financial assistance for non-QHPs or expand the availability of catastrophic plans, potentially increasing consumer choice and making coverage more affordable

- Account-Based Subsidies: Direct public subsidies into a defined-contribution, consumer-directed account that an individual uses to pay health insurance premiums or other health care expenses.

“Now is the time for states to take action to reassert their traditional role in overseeing their health insurance markets, including by establishing their own State-Based Exchanges,” Pate adds.