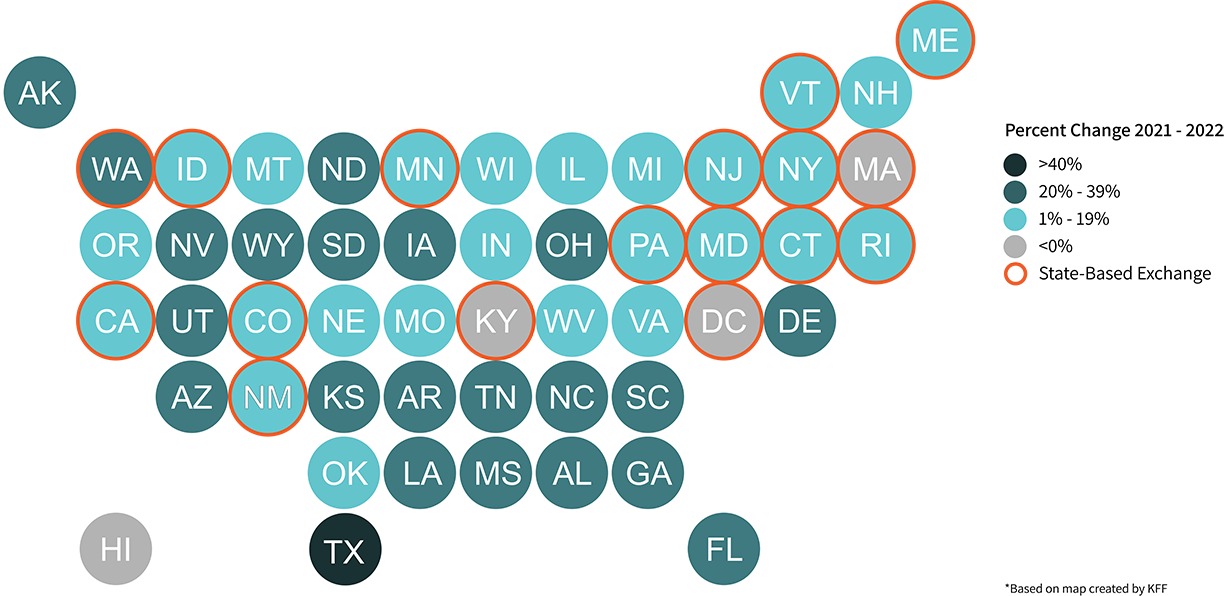

Enhanced subsidies enacted through the American Rescue Plan Act bolstered health insurance affordability and, consequently, most states across the country saw record-level enrollments for 2022. In fact, several states saw year-over-year increases of more than 30 percent. This is great news for Americans and provides states yet another reason to set up their own health insurance exchanges.

For those states operating their health insurance exchanges on HealthCare.gov, these additional enrollments translate into billions of incremental dollars in user fees to the federal government that could be used in the state to support enhanced enrollment efforts and assistance if they were operating their own exchanges. When a state sets up their own health insurance exchange, they can use the savings realized from not paying federal user fees to lower consumers’ monthly premiums, set up reinsurance pools, develop enrollment efforts in underserved populations, and/or place it in the state’s general fund, to name a few examples. Whatever the state decides, the important piece is, the state gets to decide.

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

(Source: Marketplace 2022 Open Enrollment Period Report: Final National Snapshot. User fee calculations are based on plan selections.)

If your state wants to learn more about how it can claw back these budget dollars, email hello@getinsured.com.