Healthcare.gov user fees were implemented as part of the Affordable Care Act (ACA) framework to sustain the operational and administrative costs associated with running the federal health insurance exchange. When the ACA was enacted in 2010, it aimed to expand access to health insurance for millions of Americans by creating a centralized online marketplace where consumers could compare and purchase insurance plans. To support this ambitious initiative, the federal government needed a sustainable funding model. User fees, charged to insurers who sell their plans on Healthcare.gov, were established as a mechanism to fund the exchange without relying solely on direct federal funding.

These fees cover a range of essential services, including technology support, call center operations, and outreach efforts to enroll more Americans in health insurance plans. By charging insurers a percentage of the premiums collected from plans sold through Healthcare.gov, the government created a self-sustaining financial model that helps ensure the long-term viability of the exchange.

HealthCare.gov and User Fees

Currently, there are 22 States that utilize the Federally Facilitated Exchange (FFE) operated by the Department of Health and Human Services (HHS) (i.e., HealthCare.gov). Consistent with the statute and implementing regulations, HHS has opted to impose user fees on health insurance issuers operating in those States that rely on HealthCare.gov. The user fee is a charge levied on health insurance companies for the use of the Healthcare.gov platform to sell their insurance plans. This fee helps to cover the operational and maintenance costs of the Healthcare.gov website, such as costs related to Exchange information technology (IT), health plan review, management and oversight, eligibility and enrollment determination functions including the call center, and consumer information and outreach.

The fee is a percentage of the premiums collected by insurers for plans sold through the marketplace. This fee can vary from year to year and the cost may indirectly affect consumers, as insurers could incorporate the fee into their pricing structure for premiums.

- For plans years 2014 to 2019, the “user fee” charged by HHS to fund HealthCare.gov was 3.5%

- For plan years 2020 and 2021, HealthCare.gov’s “user fee” was reduced to 3%

- For 2022, the user fee was 2.25%

- For 2023, the user fee was 2.75%

- For plan year 2024, the user fee is 2.2%

State-Based Exchanges on the Federal Platform (SBE-FPs) and User Fees

There are currently three States that are operating their own State-based Exchange, but these States are still using HealthCare.gov as their enrollment and eligibility determination platform. For those States that only use HealthCare.gov as their enrollment and eligibility determination platform (where these States conduct their own health plan certification reviews and consumer information and outreach), the user fee is still used for things like IT and call center functions. These partnership marketplaces have lower user fees than those states fully leveraging Healthcare.gov.

- Starting in 2017, these States were required to pay a 1.5 percent user fee

- For plan year 2021, the user fee increased to 2.5 percent

- Plan year 2022 was 1.75%

- Plan year 2023 was 2.25%

- Plan year 2024 is 1.8%

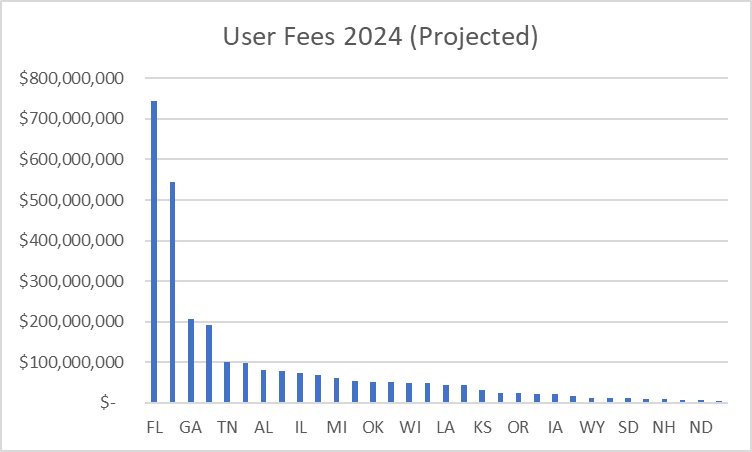

Illustration

In the case of a State that relies on HealthCare.gov to perform ALL its Exchange functions, the chart below should give you some perspective on how much money the “user fees” generate for HHS.

State-Based Exchanges and User Fees

State-based exchanges (SBEs) are health insurance marketplaces operated by individual states, offering an alternative to the federal Healthcare.gov platform. Unlike the federal exchange, which imposes user fees on insurers to fund its operations, state-based exchanges have the autonomy to set and collect their own user fees. Like Healthcare.gov, these fees are charged to health insurance companies for participating in the state’s marketplace, and are used to finance the operational costs of the SBEs. The structure and amount of these fees can vary significantly from state to state, reflecting differences in the cost of running these platforms, the strategies to promote market competitiveness, and the goal of making health insurance more accessible and affordable for residents. This approach allows states to tailor the operation and funding of their exchanges to better meet local needs and preferences, potentially offering advantages in terms of efficiency and responsiveness to state-specific health insurance market dynamics.