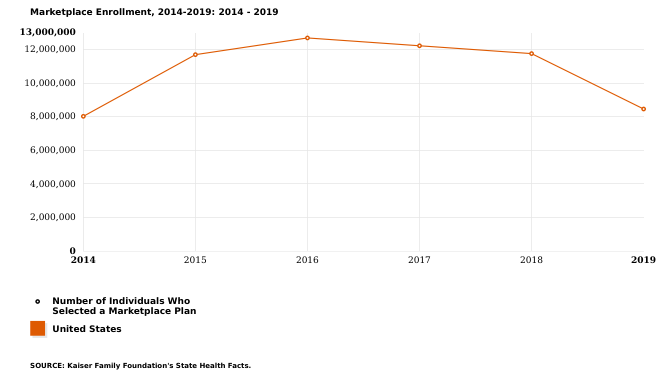

The State-Based Marketplace Open Enrollment Period (OEP) is not over yet, in most cases, but across the board states that chose to build and maintain their own exchange are showing higher enrollment numbers year-over-year. In Idaho, for example, this year’s open enrollment brought the second highest enrollment ever; 103,154 Idahoans selected a plan, which was a 1.3% increase over last year. In contrast, the enrollment in Federally Facilitated Marketplace (FFM) states was down 367,000 or 4% nationwide for OEP 2019.

Open Enrollment in the 39 FFM States ended on December 15, 2018, and preliminary per-state numbers are finally available; we are starting to see insurance commissioners and other public officials attempt to explain their state’s performance. Unfortunately, there is no one answer to what causes an increase in enrollments in a particular state, let alone what caused dramatic declines of nearly 20% in states such as Virginia and West Virginia.

Reasons cited for the declines include: lower unemployment, fewer insurers in the marketplace, unaffordable premiums, more plan options to choose from – including short-term/skinny plans, repeal of the individual mandate, the Trump administration’s policies, CMS rulemaking and their impact on ACA, lack of marketing dollars and support for navigators and other assisters, etc. But these and many other factors are present across the country, not just FFM states. Even the FFM states that tried to stem the tide saw decreases, including New Jersey, a state that experienced an 8% or approximately 22,000 enrollee decline this year even after they imposed a state-level individual mandate, set up a reinsurance program, and limited the sale of short-term plans. Conversely, Oklahoma, a state that has arguably done little to shore-up its enrollment, has seen a 6.6% increase to reach a record high of 150,849 enrollees.

In this ever-so-volatile individual and family health insurance, the only way for a State to maintain stability is to establish a State-Based Marketplace. States and state insurance commissioners will have better control over their health insurance markets, keep enrollments stable and premiums in check, all while avoiding rolling the dice during open enrollment.