There have been quite a few theories and projections on what direction the health insurance market would take both during and after the COVID-19 pandemic. Last week, the Economic Policy Institute wrote, “Extreme churn after February 2020 has led to very large losses in Employer-Sponsored Insurance (ESI) coverage. In March and April, for example, new hiring led to 2.4 million workers gaining ESI coverage each month, but historically large layoffs led to 5.6 million workers losing coverage each month. This rate of lost coverage—over 3 million workers—dwarfs a similar calculation for the number of workers losing coverage each month during the biggest job-losing period of the Great Recession (September 2008–March 2009).”(1) The question was (and very much still is) how this rush of Americans into unemployment will impact ACA exchanges as well as Medicaid enrollments.

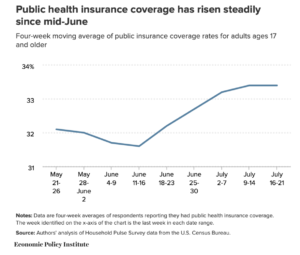

What the market is seeing isn’t necessarily what many experts anticipated. Many people who lost ESI coverage may very well still be on their company’s COBRA plan and may have yet to decide on what to do for coverage when COBRA expires. Other employers are not required to offer COBRA, while some may have kept employees on their insurance plans if the employees were furloughed. So what we are seeing today may not necessarily be how the situation ultimately resolves itself. That being said, it’s important to note what is happening right now — enrollment in both exchanges and Medicaid is steadily increasing.