The Affordable Care Act (ACA) has certainly seen its share of ups and downs since its inception, but one thing has become clear—states operating their own marketplaces weather these changes much better than their federally facilitated (FFM) counterparts – the states that chose to use healthcare.gov for both software and operations. In fact, The Commonwealth Fund recently analyzed some of the areas states with State-Based Marketplaces (SBMs) consistently come out ahead. Some key highlights from the study include:

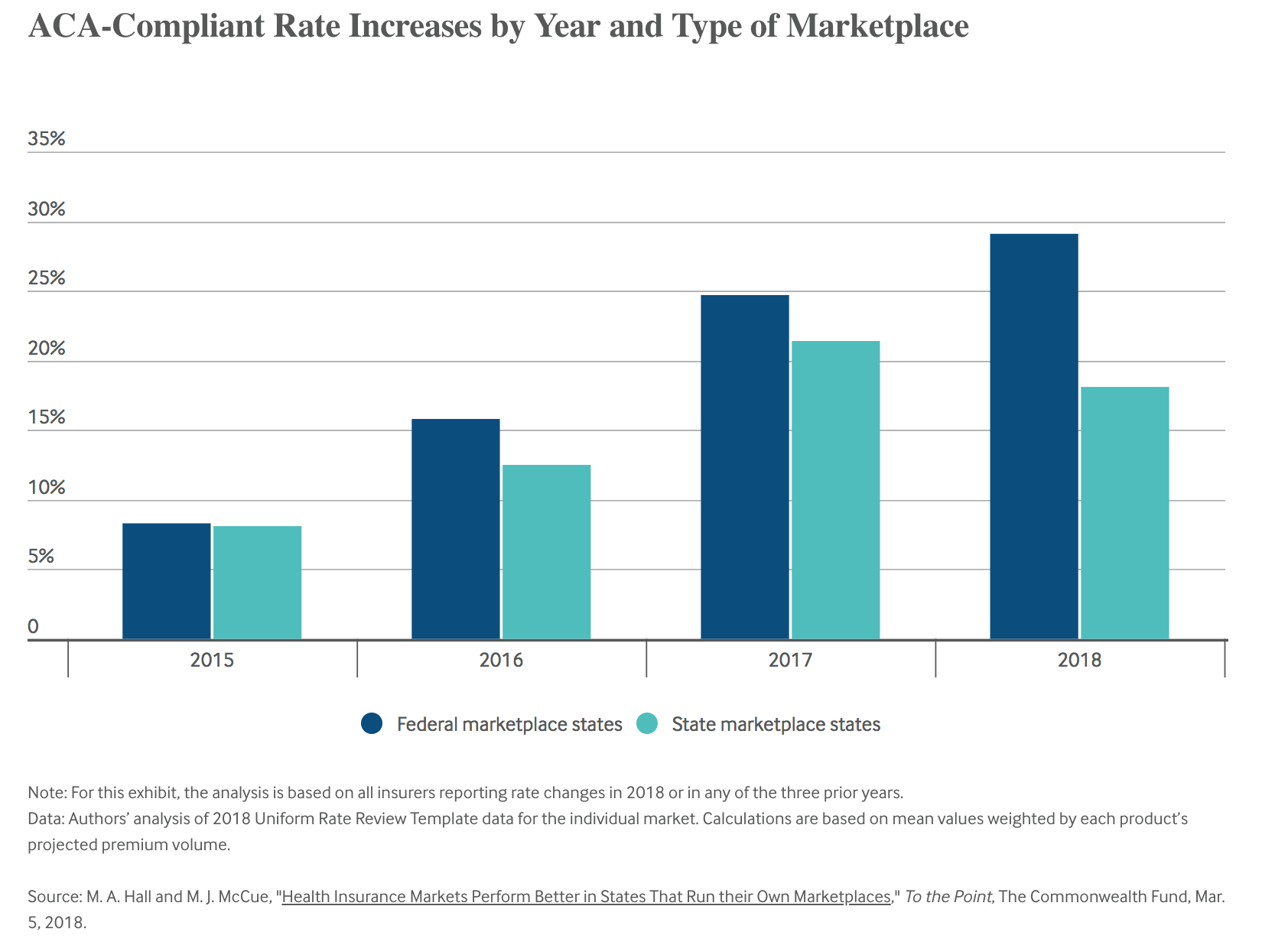

- Since the third year of the ACA, premium increases have been consistently higher in FFM states. For the past two years, increases between state and federal marketplaces have differed by 21 and 68 percent.

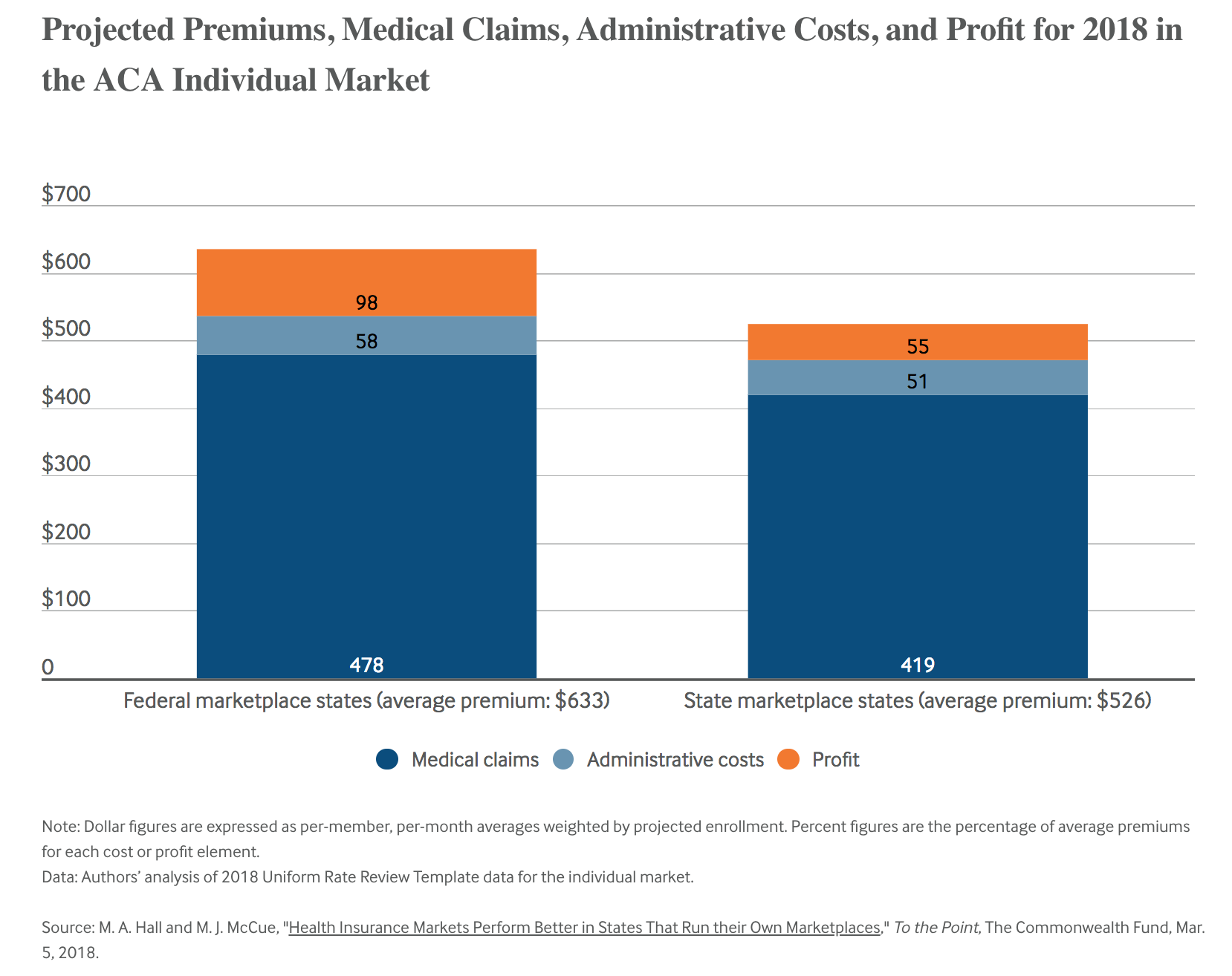

- For 2018, FFM states projected medical claims that were 18 percent higher than state-based marketplaces.

- Insurers also projected higher administrative costs per member in FFM states, which added to the premium differences.

So, what’s causing the rate differences? State marketplaces have taken the reigns into their own hands when it comes to making health insurance enrollment both profitable and sustainable. They have more control over the enrollment process, marketing campaigns, and even enrollment deadlines. Outreach efforts and enrollment flexibility that best serve their residents have proven effective with more balanced risk pools that not only encourage insurers to stay in the market but to do so with better rates than residents would find on the FFM.

Since the launch of the ACA, technology and operations of state-based marketplaces have evolved as the market and individual state needs have changed. There are now mature solutions on the market, deployed, and best practices that can help keep costs down and operations nearly flawless, resulting in sustainable SBMs.

Want to learn more about how switching to a state-based marketplace can better serve your state? We can help. Email us at hello@getinsured.com and we’ll be sure to get back to you.