On May 15, 2019 Centers for Medicare & Medicaid Services (CMS) released the 2018 Federally Facilitated Marketplace (FFM) user fees. These are the fees that the FFM collects from each state that operates on the FFM platform. The 2018 assessment fees were based on 3.5 percent of the aggregate premiums paid by enrollees for states using both the front-and back-end functionality of the FFM, and 3 percent for FFM-partnership (FFM-FP) states, those states that only used the back-office features of the platform. According to the report, CMS collected a total of $1.87B from 39 states, ranging from $3.7M in North Dakota to $361M in Florida.

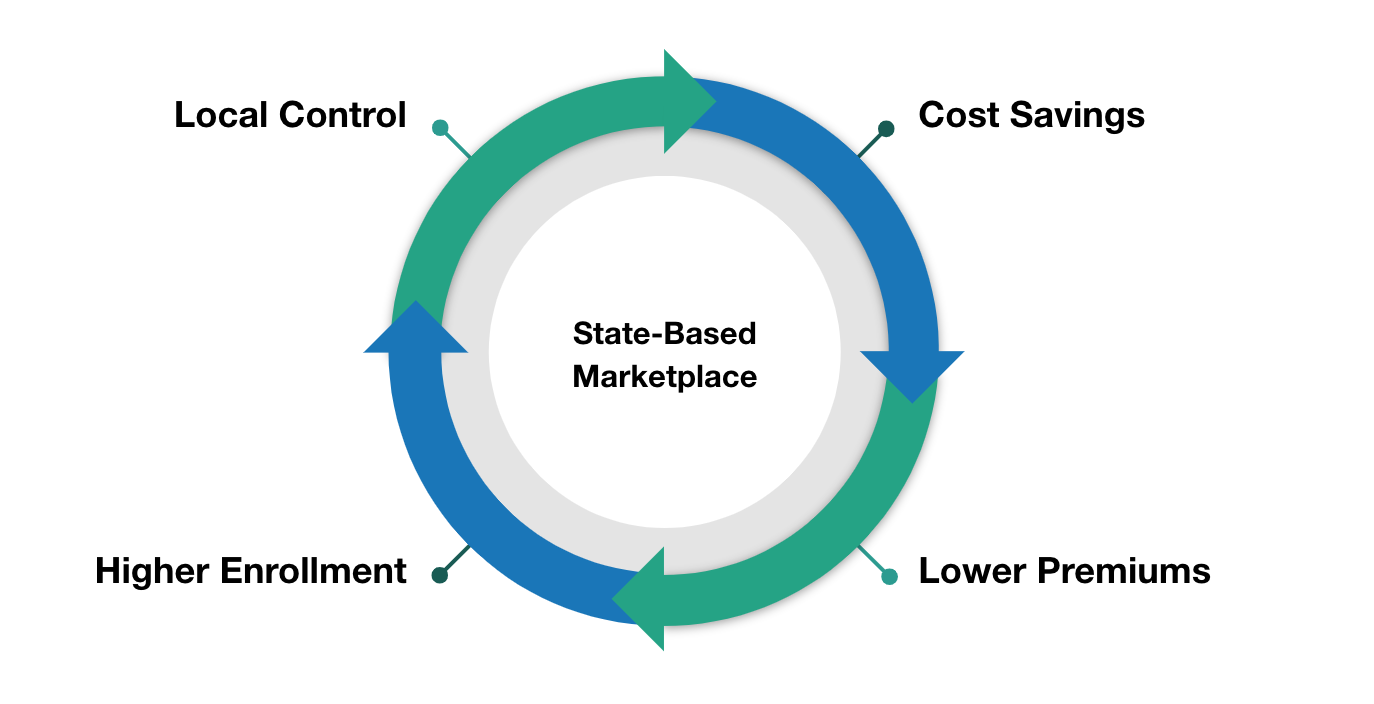

Many of the FFM and FFM-FP states, especially those on the higher-end of the fee scale, would benefit from moving off of the FFM and starting their own state-based marketplace (SBM). We recently explored the benefits to states if they take control of their health insurance markets, which includes:

- Significant cost savings;

- Lower insurance premiums;

- Increased enrollments; and

- Greater local control… something all states agree on.

The table below will help you identify what your state paid to FFM in 2018.

| wdt_ID | State | FFM User Fees | Exchange Type |

|---|---|---|---|

| 1 | AK - Alaska | $5,220,053 | Federally-Facilitated Exchange |

| 2 | AL - Alabama | $41,884,174 | Federally-Facilitated Exchange |

| 3 | AR - Arkansas | $6,873,849 | Federally-Facilitated Exchange |

| 4 | AZ - Arizona | $37,265,061 | Federally-Facilitated Exchange |

| 5 | DE - Delaware | $6,187,484 | Federally-Facilitated Exchange |

| 6 | FL - Florida | $361,087,153 | Federally-Facilitated Exchange |

| 7 | GA - Georgia | $94,523,892 | Federally-Facilitated Exchange |

| 8 | HI - Hawaii | $4,315,483 | State-Based Exchange on the Federal Platform |

| 9 | IA - Iowa | $17,052,059 | Federally-Facilitated Exchange |

| 10 | IL - Illinois | $76,180,904 | Federally-Facilitated Exchange |

| State | Exchange Type |

Our forecast for FFM user fees for 2019 are in line with the fees assessed in 2018. Specifically, based on the enrollment and premium trends as reported to date, we anticipate the fees the FFM collects in 2019 to be lower by only 0.35 percent compared with this year, even with the recently announced assessment fees for FFM and FFM-FP states (3 percent and 2.5 percent, respectively) in 2019. Given the high user fees, which are being passed along to consumers in the form of higher monthly premiums, it’s no surprise that several Democratic and Republican governors have expressed interest in migration off of the FFM. If you want to learn more about how your state can save and gain local control, email our Business Development Team at hello@getinsured.com.