In recent years, encouraging those who are eligible for subsidies to enroll in Marketplace coverage has become a major focus for many states. Reducing the number of uninsured improves the wellbeing of state residents, lowers the rate of uncompensated care for providers, and brings federal dollars into the state.

Several states have begun to explore, and in some cases initiate, facilitated enrollment strategies to directly connect uninsured consumers to Marketplace and Medicaid coverage and simplify the enrollment process. For example, Maryland was the first state to adopt Easy Enrollment, which uses tax forms to connect the uninsured with coverage. Other states such as Colorado, Virginia, and New Jersey have begun to explore this type of program as well. Last year we took a quick look at Easy Enrollment; with more states planning to leverage tax time to lower the uninsured rate, let’s take a deeper look at how Maryland has executed the program.

Maryland: Connecting the Uninsured to Affordable Coverage

In May 2019, Maryland created the state’s new Easy Enrollment Health Insurance Program (MEEHP), a tax time enrollment pathway, providing assisted enrollment into Medicaid and Qualified Health Plans (QHP) on a Maryland Health Benefit Exchange with a special enrollment period. This program is a partnership between the Maryland Health Benefit Exchange and the Office of the Maryland Comptroller, and represents the country’s first attempt to use income tax filing as an on-ramp to health coverage.1

There continues to be a strong connection between tax filing and eligibility for insurance affordability programs. MEEHP’s leveraging of tax return provides both a remarkable opportunity to identify the uninsured and could help overcome one of the most serious obstacles to coverage: namely a lack of information about available assistance. Nationwide, there are a lot of misconceptions about the availability and affordability of health coverage, and Maryland expects that their new program will help to move past these misconceptions.

The MEEHP: How it Works

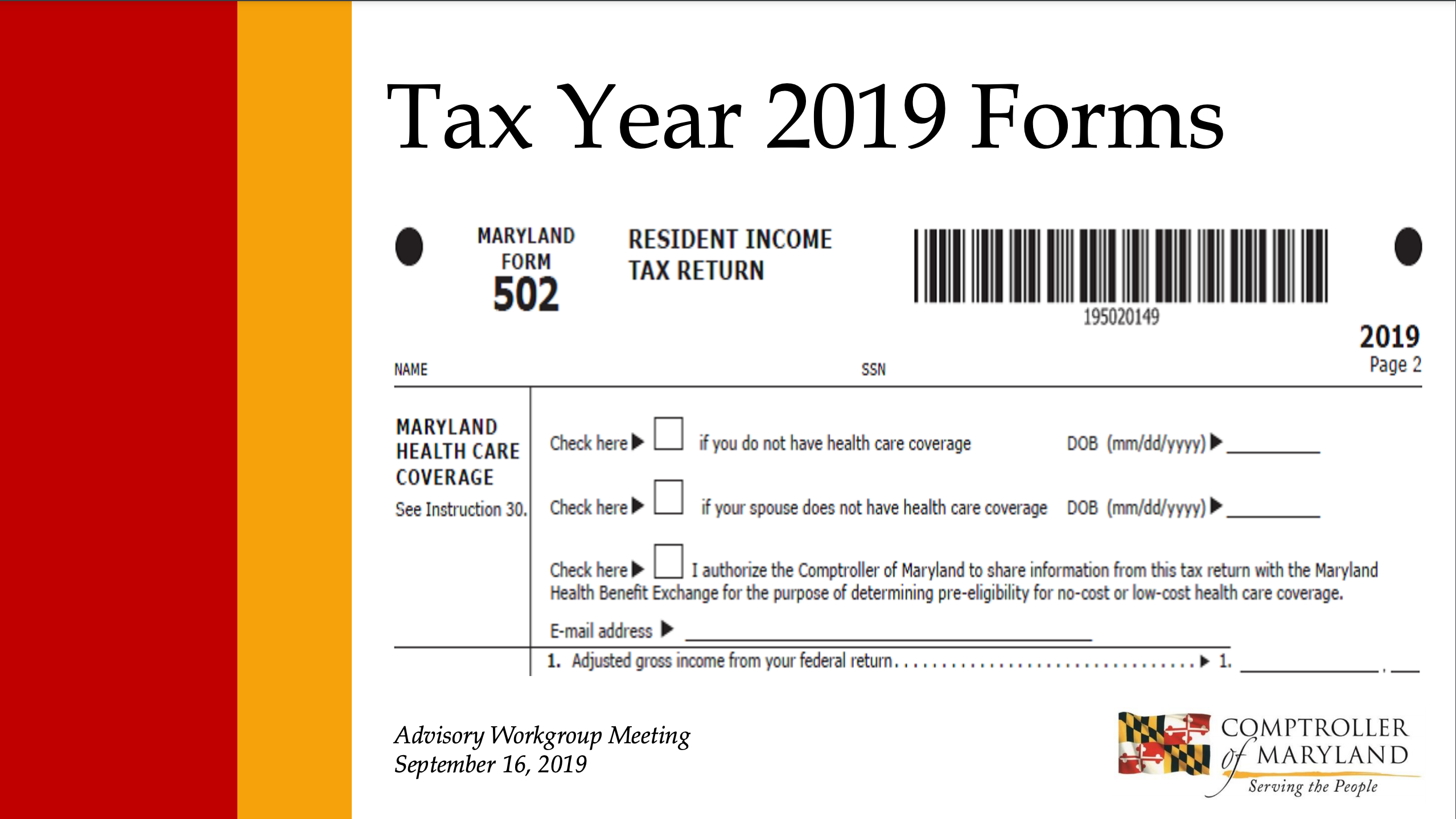

Considering the lengthy process for integrating their complex information systems, Maryland’s program is being implemented in stages.2 For the 2020 tax filing season, the State income tax return included just two new questions: whether anyone in the household was uninsured, and whether the Comptroller could share information, like household size and income, with the Maryland Health Benefit Exchange to see if the uninsured members in the tax household were eligible for free or low-cost health insurance (Figure 1).

Figure 1: Example of the tax forms used by Maryland state tax department

The Results

Using this approach, the exchange was able to deliver SEP eligibility notices to over 40,000 households. More than 4,000 Marylanders enrolled into insurance affordability programs through the MEEHP, with the majority (75%) enrolling into Medicaid. Nearly 66.1% of enrollees were younger than 34 years old and 50% were from households with incomes of less than 100% of the federal poverty level. Data indicates that the program has the potential to target disproportionately uninsured populations. Tax time intervention also allowed Maryland Health Benefit Exchange to increase awareness and visibility for the Marketplace among the uninsured population.

In 2021, according to the Maryland Easy Enrollment Health Insurance Advisory Workgroup, Maryland Health Benefit Exchange intends to fully implement the MEEHP by providing complete eligibility determination for uninsured tax filers seeking coverage as well as auto-enrollment into Medicaid/ Maryland Children’s Health Program (MCHP).

More States Following Maryland’s Example

Realizing that they can leverage the natural connection between health insurance and tax filing to increase enrollment among the uninsured, other states have followed Maryland’s example. Colorado’s “easy enrollment” program will debut in early 2022. Colorado residents will be able to indicate on their state tax returns that they would like the State Based Marketplace ‘Connect for Health Colorado’ to determine, based on the information in their tax returns, whether they might be eligible for free or subsidized health coverage. If so, the exchange would be able to reach out to the filer to help them enroll in coverage. New Jersey launched as a state-based exchange in 2021 and has advanced legislation for a similar program. Virginia expects to have a state-based exchange in 2024 and plans to launch its “easy enrollment” program on or after January 1, 2022, in a phased manner.3

Best Practices to Implement an “Easy Enrollment” Program

As states explore options to implement an “Easy Enrollment” program, we believe there are three key best practices to keep in mind:

- Require just enough data on the state tax form to enable the state–based exchange to provide an initial program eligibility assessment (for Medicaid or Qualified Health Plan) and an estimated savings amount (for APTC/CSR-eligible population).

- Send follow up notices summarizing eligibility and savings with clear next steps to make the enrollment process both easy to understand and undertake.

- Enable consumers to easily select coverage and enroll by streamlining the application and enrollment process for those who qualify for a tax-return SEP.

Early results from Maryland are promising, and the fact that several states are following Maryland’s example points to the enormous potential this type of program offers to reduce uninsured rates. States with income tax and those that have uninsured rates over a certain threshold, should consider implementing this innovative ‘tax return to enrollment’ program.

—

References

1 Nearly 58,000 Marylanders Gain Health Coverage During Two Special Enrollment Periods, July 16, 2020

https://content.govdelivery.com/accounts/MDHC/bulletins/296096e

2 Maryland Easy Enrollment Health Insurance Program Advisory Workgroup, September 2019

https://www.marylandhbe.com/wp-content/uploads/2019/09/Presentation-9.16.19.pdf

3 Virginia Bill HB 1884

https://leg1.state.va.us/cgi-bin/legp504.exe?212+ful+CHAP0162+hil