To date, 14 states have leveraged 1332 waivers to set up health insurance reinsurance programs to help lower premiums. At a high level, these programs provide payments to health insurers to help offset the costs of certain medical claims. These savings, in turn, are passed down to the consumer in the form of lower premiums than the insurers would be able to offer otherwise.

Through 1332 waivers, states ensure that part of their reinsurance funding comes from the federal government pass-through funds. (You can see how that dollar amount is calculated here.) Currently, the pass-through dollars are two to three times the state’s investment, setting up a significant reinsurance pool. Even though 1332 waivers can be used for a variety of innovative changes, virtually all of the 1332 waiver proposals that have been submitted and approved by CMS have been for the purpose of establishing reinsurance programs.

The idea is that the reinsurance program lowers the cost of health insurance, which means that premium subsidies don’t have to be as large in order to keep coverage affordable, and that saves the federal government money (since premium subsidies are funded by the federal government). By using a 1332 waiver, the state gets to keep the savings and use it to fund the reinsurance program. That money is referred to as “pass-through” savings since it’s passed through to the state.

States generally need to come up with some of the funds for reinsurance on their own, so there’s often an assessment on insurance plans in the state in order to raise the revenue that the state needs to fund its reinsurance program. But states can take creative approaches to come up with the funding they need.(1) For example, New Jersey will pull funds from the New Jersey Health Insurance Market Preservation Act, which requires residents to maintain health insurance coverage or make a Shared Responsibility Payment. Virginia initially proposed instituting a tobacco tax to fund its reinsurance pool but has since decided to move in another (not yet defined) direction. A state making the move off of the FFM, like Virginia, could easily fund its reinsurance pool with the estimated savings of operating a state-based marketplace. Nevada, for instance, estimated their savings to be 50 percent. Actual savings ultimately depend on the size of the state’s enrollment and premium costs.

Rates are currently being filed, so we are seeing whether or not the savings, which have been theoretical for many states until now, are coming to fruition.

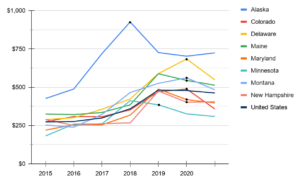

- Alaska launched its reinsurance program in 2017 and was the first state to set up a reinsurance program. Premiums in 2017 averaged $926, in 2018 they fell to $726, and even further in 2019 to $702. After a slight uptick in 2020 rates, we are waiting to see what the rates will be for 2021.

- Colorado’s program went into effect in 2019 and the state saw average premiums go from $488 to $358 in 2020.

- The Delaware exchange insurer Highmark proposed an average rate decrease of half a percent. Delaware’s reinsurance program, which took effect this year, is keeping premiums lower than they would otherwise be; without the reinsurance program, Highmark’s filing indicates that they would have proposed a small rate increase for 2021.(2)

- Maine implemented their program last year and is seeing a 13.1% decrease in premiums for 2021.

- Maryland’s reinsurance program took effect in 2019. Before the reinsurance program was approved, insurers had proposed an average rate increase of about 30%. After the reinsurance program was approved, insurers filed new rates (which were subsequently approved by regulators) that amounted to an average premium decrease of more than 13%.(1)

- Minnesota‘s reinsurance program took effect in 2018 and the state has seen steady decreases year over year.

- In Montana, Blue Cross’s average rate increase for 2021 policies will be zero, and Mountain Health Co-op will see an average rate increase of 0.68%. The two companies write about 80 percent of the policies in Montana. Premiums for the 2020 policies had declined from the previous year because the 2019 Montana Legislature enacted a reinsurance program that helps cover expensive claims in the individual market.(3)

- New Hampshire’s rates will drop by more than a fifth from this year. The proposed rate of a silver plan, the second-lowest, will go down from $404.80 a month to $318.95, a 21.12% decrease.(6)

- New Jersey The New Jersey Health Insurance Premium Security Plan took effect in 2019.

- North Dakota, implemented its reinsurance program in 2020 which decreased premiums by nearly 6% for 2020 as a result. Without it, they would have increased by nearly 15%.(5)

- Oregon’s program took effect in 2018 and they are the anomaly of the group, as their rates have increased year-over-year.

- Pennsylvania’s rates could fall by a statewide average of 2.6% in 2021.(7)

- While rates in Rhode Island will be increasing for 2021, the rate increases were not as large as requested by the insurance companies.(4)

- The Wisconsin Healthcare Stability Plan (WIHSP) took effect in 2019 and the state saw a drop in average premiums for 2020.

- What Is Reinsurance and Why Are States Pursuing It?

- The Scoop: health insurance news – August 26, 2020

- Affordable Care Act individual policy rates for 2021 mostly hold steady in Montana

- Raimondo Admin Approves Health Insurance Rate Increases – Some Nearly 10%, Neronha Criticizes

- North Dakota health insurance marketplace: history and news of the state’s exchange: Affordable Care Act enrollment

- Exchange insurance premiums for NH individuals could drop by over 20% in 2021

- Insurers propose lower rates for Pa. Affordable Care Act plans in 2021